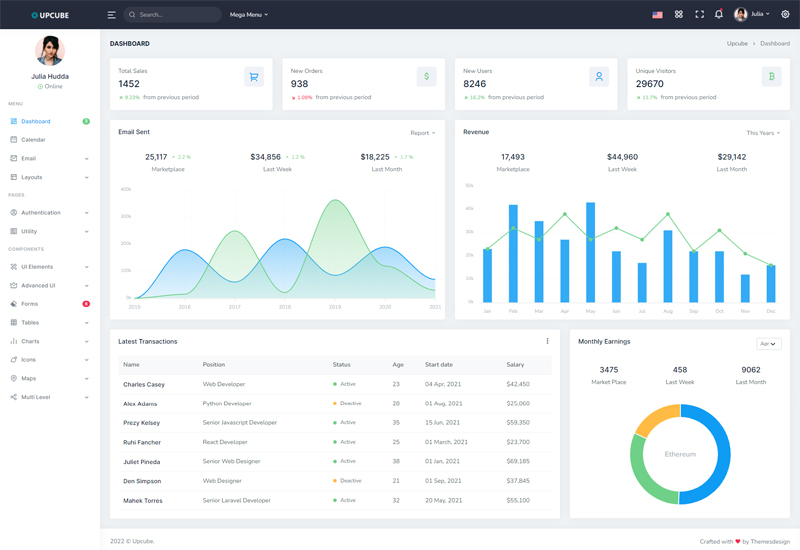

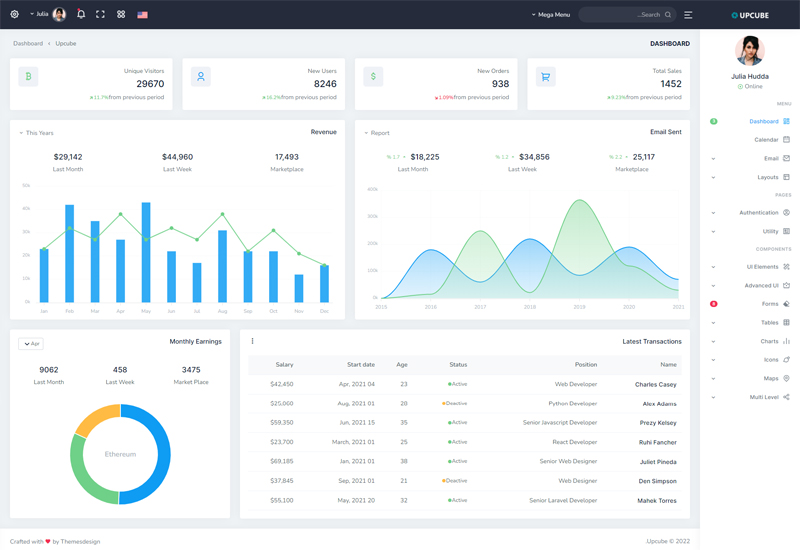

My Plan

State: Connecticut

Net Worth (in today's dollars)

At 65

$-470,327

At 75

$-777,107

At 85

$-1,187,045

Key moments (in today's dollars)

Age 41.0

Savings run out

Your net worth (in today's dollars)

Want to change your future?

Explore scenarios in the Forecast →Your inputs

Income

No income added yet.

Housing

Loading...

Loading...

Expenses

Saving 15% of income

Target savings rate

% of gross income

How much you want to save each year

Minimum living expenses

% of income or

$/yr minimum

Bare minimum you need to live on

Lifestyle floor

% of peak spending

Once you've lived at a certain level, expenses won't drop below this % of your peak

How it works: Each year, you save 15% of gross income and spend the rest on living expenses. Your spending won't drop below 13% of income (or $13,000/yr), and never below 70% of your historical peak spending.

Investments

$0 saved.

Cash savings

Checking, savings accounts

Investment account

Stocks and bonds (brokerage accounts)

401(k)

Expected annual returns

Stocks:

%

Bonds:

%

Stocks: $0 | Bonds: $0

401K Stocks: $0 | 401K Bonds: $0

Debts

No debts

No debts added.

→ Add/edit debts in Einscow's Lab